Know Your Investor: Invus (July’24 Edition)

Shots:

- Backed with an evergreen investment strategy, Invus makes investments across several company stages ranging from early growth to turnarounds

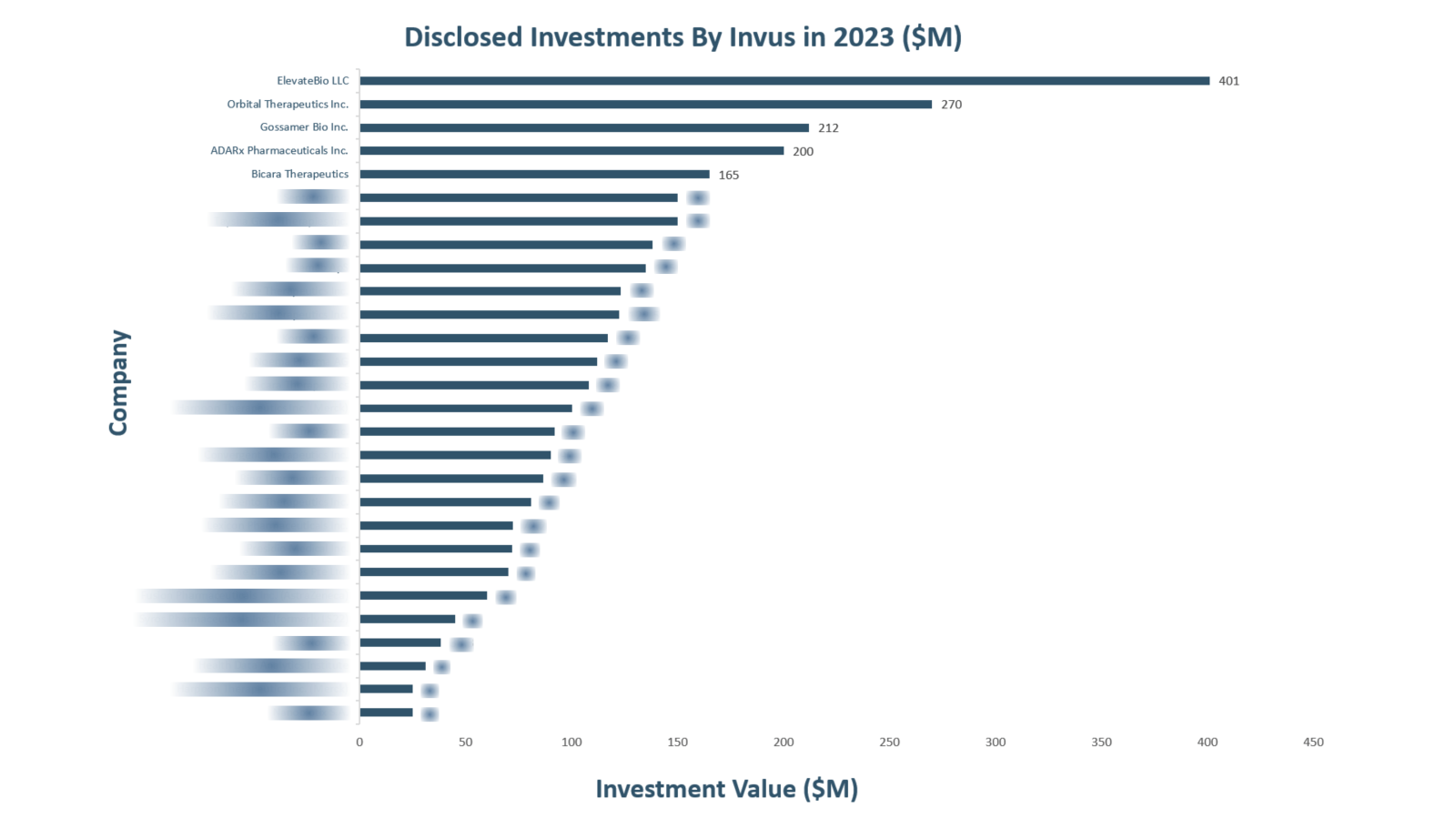

- In 2023, Invus participated in 6 investment rounds in around 29 companies focusing on biopharma, manufacturing & services, and devices

- For a curated report on a specific investor or venture capital, reach out to us at connect@pharmashots.com

Invus

Founded in 1985, Invus is an investment company with a presence in New York, Paris, and Hong Kong. Ever since the company started, the source of funding remained a European family group. With its evergreen investment approach, Invus' small initial pool of funds expanded to nearly $10B. The company partners with owner-managers and invests across a wide spectrum of companies, ranging from early-stage growth to turnarounds, with initial investments ranging from $10M to $800M. The company participates in both major and minor investments.

Invus’s portfolio includes companies operating in consumer goods and services, food, specialty retail, software, biotech, medical devices & products, and professional services. The company invests in companies throughout the world, with an emphasis on the United States, Europe, China, and India, utilizing its flexible structure and team's international knowledge.

In 2023, Invus participated in six investment rounds comprising Pipe, Debt/Loan, Series A, B, C, and D. Companies like Syros Pharmaceuticals Inc. (formerly LS22), Bicara Therapeutics, Fusion Pharmaceuticals Inc. (now part of AstraZeneca) and ADARx Pharmaceuticals Inc., are in Invus’ investment portfolio. In 2023, ElevateBio LLC received the highest funding worth $401M.

In 2023, Invus closed 29 healthcare investments, with a focus on biopharma, manufacturing and services, and devices. Of the 29 investments made, 27 were in biopharma firms. The firm concentrates on oncology, neurology, autoimmune, cardiovascular, endocrine/metabolic, hematological, hepatic, inflammatory, ophthalmology, and pulmonary. Invus also made significant investments in technologies that include antibodies, AI/ML, cell therapy, devices (general), gene therapy, immunotherapy, nano therapy, radiation/radiotherapy, RNA, small molecules, and so on. Furthermore, 37.3% of Invus' total investments in 2023 were made through Pipe, with 20.6% made through Series B. Invus' top three investments are as follows:

-

Series D funding worth $401M to ElevateBio LLC

-

Series A funding worth $270M to Orbital Therapeutics Inc.

-

PIPE funding worth $212M to Gossamer Bio Inc.

In 2023, Invus made:

-

9 investments in Q1

-

6 investments in Q2

-

7 investments in Q3

-

6 investments in Q4

The table below represents the top 5 funding rounds out of the 29 investments made by Invus in 2023:

Note: For a complete report, reach out to us at connect@pharmashots.com with the subject line "Invus Investment data"

Related Post: Know Your Investor (June Edition): Google Ventures

Tags

An avid reader and a dedicated learner, Prince works as a Content Writer at PharmaShots. Prince possesses an exceptional quality of breaking down the barriers of words by simplifying the terms in digestible chunks to make content readable and comprehensible. Prince likes to read books and loves to spend his free time learning and upskilling himself.